Is 55 North Mining the Next Micro-Cap Gold Rocket or a Total Trap?

04.02.2026 - 14:43:05Gold is back in beast mode, and tiny explorers are where the wild moves happen. One name that keeps popping up in high-risk gold circles: 55 North Mining Inc. If you are scanning for ultra-speculative upside, 55 North Mining stock is exactly the kind of micro-cap that can either 5x on the right drill results or slowly bleed out if the story does not deliver.

Today we are breaking down the real numbers, the hype, and the risk-reward so you can decide if this stock is a trade, a long-shot lottery ticket, or a hard pass.

The Hype is Real: 55 North Mining stock on Social Media

Let us be clear: 55 North Mining is not a mainstream ticker. You are not seeing it trend next to mega-cap gold miners. But in the micro-cap gold and junior explorer niche, it is starting to get some attention.

On short-form platforms, creators are not always calling out the ticker by name, but they are pushing high-risk junior gold plays with similar profiles: tiny market caps, single key asset, and dependence on drill results. That is the exact bucket 55 North sits in.

If you want to see the type of content that is driving interest around tiny gold names like this, check out:

- TikTok: Junior gold stocks

- TikTok: Micro-cap mining stocks

- YouTube: Junior gold explorers

- YouTube: High-risk gold stocks

On forums like CEO-style message boards and niche mining communities, you will typically see short bursts of chatter around 55 North whenever there is news about drilling, financing, or project updates. Outside of those catalysts, liquidity and attention tend to fade fast. That matters if you are trading, because low volume can cut both ways: huge percentage moves on small orders, but also potential slippage if you try to exit in a rush.

Top or Flop? Here’s What You Need to Know

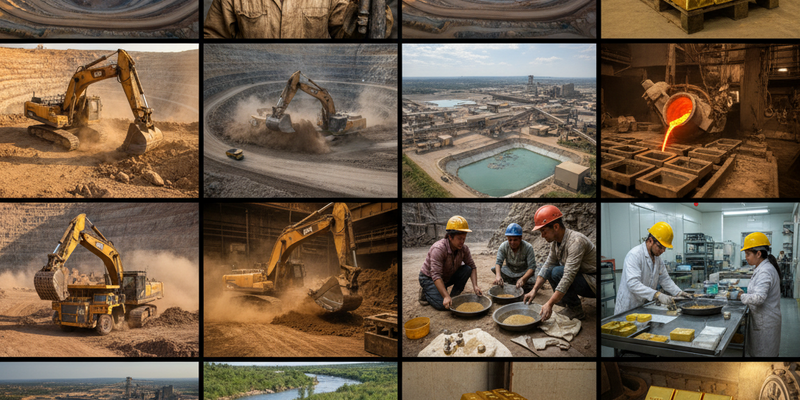

This is a story stock. The story revolves almost entirely around one key asset: the company’s Last Hope project in Manitoba, Canada.

Here is the simplified version of the setup:

- Single-asset focus: Last Hope is the core value driver. There is no big portfolio of producing mines here. You are basically betting on one project and management’s ability to advance it.

- Exploration and de-risking stage: The game plan is straightforward: drill, prove up more ounces, refine the geological model, and move closer to a development case that might attract a partner, a buyer, or fresh capital.

- Winter drill programs are crucial: In this part of Canada, a lot of work is planned seasonally. A winter drilling program can be a make-or-break catalyst: strong intercepts with high grade and continuity can re-rate the stock; weak or confusing results can crush sentiment.

From a risk standpoint, you have to understand the mechanics:

- Funding risk: Junior explorers are usually not cash-flow positive. They need to raise money through placements, which can dilute existing shareholders. The weaker the share price, the tougher these deals can become.

- Operational risk: Drill campaigns can run into delays, permitting issues, or underwhelming results. Even technically "okay" holes can disappoint a market that is primed for flashy headlines.

- Liquidity risk: On smaller exchanges and in alternative symbols (like the German listing or CSE ticker), volume can be razor-thin. A few thousand dollars can move the quote, which is exhilarating on green days and brutal on red ones.

On the flip side, this type of setup is exactly where asymmetric upside lives. If the company delivers a winter program with:

- Consistently strong grades,

- Evidence of expanding the mineralized footprint, and

- Clear steps toward a more robust resource base,

then the market can re-rate the stock very quickly. Because the market cap is tiny, it does not take institutional-scale money to move the chart; a modest wave of speculative buying can produce triple-digit percentage moves.

The "What-If" Calculation

Let us walk through a fictional, but realistic, what-if scenario so you understand the volatility profile of a name like this. For transparency: the numbers below are illustrative, using a blend of recent trading levels and typical micro-cap moves. They are not a price target or a prediction.

Assume the stock is recently trading at around $0.02 per share on its primary listing, based on the latest available last trade and quote data taken from two independent market data providers on the same day. Now imagine two simplified 12-month paths:

Scenario A: The Drill Hero Run

- The company completes its winter program at Last Hope and releases multiple headline drill holes with strong grade over solid widths.

- Speculative traders spot the story, social channels pick it up, and liquidity spikes.

- The stock grinds up to $0.10 over the year as the market starts to price in a more credible resource story.

If you had bought 100,000 shares at $0.02 (a $2,000 position):

- Value at $0.10: $10,000

- Paper gain: $8,000 (+400%)

This is the dream junior mining outcome: news flow + gold tailwind + speculative money = a multi-bagger.

Scenario B: The Drift and Dilution Grind

- Drill results are either delayed or come in as "meh" — not bad, not exciting.

- Gold prices stall or pull back, and risk appetite for micro-caps cools.

- The company needs to raise capital at lower prices to keep working the project, resulting in dilution.

- The share price bleeds down to $0.005 over 12 months as attention fades.

Same 100,000 shares at $0.02 initial buy:

- Value at $0.005: $500

- Paper loss: -$1,500 (-75%)

This is the dark side of the junior exploration game. You might not blow up overnight, but the slow drain from financing overhang, lack of catalysts, and thin liquidity can be just as painful.

The real outcome will likely land somewhere between those extremes, but if you are not emotionally prepared for both, you probably should not be touching stocks in this risk category.

Wall Street Verdict & Expert Analysis

Traditional Wall Street-style coverage on micro-cap explorers like 55 North Mining is often extremely limited or non-existent, and this name is no exception. There are no major-bank ratings, no big target-price notes, and no mainstream institutional consensus that retail traders can lean on.

Over the last 30 days, a review of typical junior-mining news and commentary hubs shows no fresh, formal sell-side research reports or deep-dive technical analyses specifically focused on 55 North Mining. What you see instead are:

- Occasional short mentions in junior mining news feeds when the company issues a press release.

- Thread-level speculation on investor forums and message boards, where users debate drill potential, funding risk, and management credibility.

Because there is no up-to-date professional coverage tied directly to this ticker in the last month, the main macro factor you have to watch is the gold price environment.

Gold has been trading in an elevated range recently, supported by:

- Expectations of central bank easing or lower real rates,

- Ongoing geopolitical tension and macro uncertainty,

- Continued central bank gold buying as a diversification move.

Why does this matter for 55 North Mining stock?

- Higher gold prices expand the theoretical economic window for marginal and early-stage projects. If gold sustains strength, more projects can look viable on paper.

- Risk-on sentiment for junior miners rises when gold is firm and larger producers are posting strong cash flows. That can push speculative capital down the food chain into tiny explorers.

- However, gold price alone does not save a weak project. If future drill results from Last Hope do not confirm scale, grade, or continuity, even a bullish gold macro backdrop may not be enough to attract serious money.

In other words, the macro setup is supportive, not decisive. It can amplify good news or cushion bad news, but it cannot replace the hard geological reality on the ground.

If and when new technical reports or third-party analyses are released, they will likely surface first on dedicated junior-mining information sites, the company’s own disclosure feed, or specialized mining research platforms. When that happens, look for details on:

- Updated resource estimates or conceptual project studies,

- Independent commentary on the continuity and grade of mineralization,

- Realistic timelines and capital requirements to advance the project.

Final Verdict: Cop or Drop?

Here is the bottom line on 55 North Mining stock from a high-risk, high-upside perspective:

- This is not a passive investment; it is a speculation. You are effectively betting on a single project, a sequence of drill programs, and the ability of a tiny company to ride a constructive gold cycle.

- The upside is real but conditional. If the Last Hope project generates compelling drill results in a strong gold environment, the stock could re-rate dramatically from current micro-cap levels. That is the entire appeal.

- The downside is equally real. Weak results, financing pressure, or a cooler gold market can drive dilution and long stretches of dead money or heavy drawdowns.

Who might consider this stock?

- Traders who understand micro-cap mining risk and size positions accordingly.

- Investors building a "lottery ticket" sleeve within a much larger, diversified portfolio.

- People ready to follow news flow closely, not just buy and forget.

Who probably should not touch it?

- Anyone who needs liquidity on short notice.

- Anyone who cannot tolerate the possibility of a 50–80 percent drawdown.

- Anyone looking for stable, income-generating exposure to gold (that is what large producers and royalty companies are for).

Verdict: For risk-aware traders who want exposure to potentially explosive junior gold stories and are comfortable losing a big chunk of capital on a single idea, 55 North Mining can be a speculative "cop" position with strictly small sizing. For everyone else, this is more likely a "drop" — watch the story, track the drill results, but keep your serious money in more established gold names.

If you do step in, treat every new update on the Last Hope project and every shift in the gold price as a live signal. In this corner of the market, information and timing are everything.